How To Use Crypto In Your Daily Life Using The Crypto.com Visa

The truth is… cryptocurrency would never take off if it’s only use was to HODLIt means HOLD. In other words, to buy it and then hold onto it. Don't sell it. Wait until the price goes up and just hol... and wait for it’s price to increase.

For it to take off, it needs to have real-world USE. People need to see it’s use case in bettering their daily lives.

Eventually, use of crypto will be so normalized that we’ll think nothing of it. But, for now, we need to be aware of the multiple advantages and then make the extra step to use it.

I already talked about how I use Celsius to earn interest rates that blow the traditional bank away by multiple orders of magnitude. Earning respectable interest on your savings is a real-world use case that normal people understand.

But, what about spending your crypto? What about using it in day-to-transactions? And how can you blow away your regular credit cards in terms of card benefits?

I am a massive fan and user of Crypto.com. I’m going to tell you here how I use it personally.

To be clear, I do not use everything that Crypto.com does. These various platforms compete with one another. And Crypto.com is best at one thing, but not other things.

Let’s talk about it…

How To Spend Your Crypto

Cryptocurrency is a broad, new asset class. Every coin has it’s own purpose and the market value of that coin is dependent on that.

Many automatically think of all crypto as… currency. But, that’s not really true. The first known use case of crypto was as a currency. That coin was, of course, Bitcoin.

As things have evolved over the last many years, the use case of Bitcoin has evolved more into a store of value (aka “digital gold”) than as a day-to-day currency.

Other coins are much better suited to use as a currency. DASH and Litecoin, for instance, would be much better suited because they are much faster. DASH, particularly, is being purpose-built for use as digital cash.

The issue is that… we still almost exclusively live and operate in a world of what will soon be “old school finance”. We live in a world of big banks, custodial bank accounts, debit cards, Visa and Mastercard.

Most transactions today are done using… plastic cards. And it all goes through centralized systems to process those transactions.

True crypto-to-crypto transactions are still pretty rare in the “real world”. Some stores and vendors take Bitcoin. In areas of the world that are more “unbanked”, you’re seeing a lot more direct crypto-fueled economic activity. But, for most of us, crypto has to be translated into old-school finance to be spent.

In other words, we’re still living in the dollar-based world. If we want to use crypto, we must use a translation layer.

The easiest way to use crypto daily is via a Visa card that is designed to work with cryptocurrency. The one I use is by Crypto.com.

With a crypto Visa card, you can use crypto to buy normal, daily things. Anywhere that Visa is accepted.

A Bit About Crypto.com

Crypto.com is one of the leading new crypto companies out there right now. They also bought, perhaps, the best domain and brand they possibly could have bought to be a major player in this space.

The company is obviously positioning itself to be a major player. They offer many difference services:

- An exchangeAn exchange is a platform that enables you to exchange one currency for another currency. It is a place where people can...

- The Visa cards (which we will be discussing here)

- Crypto Earn (so you can earn interest on your crypto holdings)

- Crypto loans

- Crypto Pay (a merchant service making it easier for merchants to accept crypto for normal transactions)

- DefiShort for Decentralized Finance. It is a brand new breed of finance that provides typical financial services in a decent... Swap (a decentralized exchange service)

As you can see, Crypto.com is getting into pretty much every facet of crypto-backed finance. The company was founded in Hong Kong, but works very closely with regulatory bodies across the globe and has, indeed, developed into one of the major brands in this space.

To be clear, I have not used – nor would I recommend – every service offered by Crypto.com. I use their Visa card and I occasionally use their app to buy other altcoins (since it is convenient). But, I don’t use most of their services as of now.

I think this company will continue to grow and do very well. In fact, if I had to guess, I think they’re heading toward a buy-out and acquisition at some point, something that was (and is) quite common in the rise of the current internet as “dot coms” were spun up and later acquired.

With the array of services they provide and the killer brand, I think Crypto.com will be one of the leading players in the new breed of bank that is coming.

How The Crypto.com Visa Card Works

This Visa card is not a credit card. It works more like a debit card. Or, technically, like a pre-paid Visa.

You will manage your account via an app. You can store a multitude of various cryptocurrencies inside of your Crypto.com account, but you will also get a fiatFiat, or fiat currency, is a currency that exists and has value merely because it's home government says so. A fiat curr... walletWe know a wallet as a thing you keep your money in. In cryptocurrency, we use the word wallet to refer, likewise, to a p... and an account for your Visa card.

When you sign up, you will choose your home currency. For me, that was obviously the US dollar. Based on that, you will get a fiat wallet that you can move money in and out of. In essence, you’re getting a bank account. There are no fees associated with it, so you have total flexibility.

In my case, the account is run by Metropolitan Commercial Bank as a standard checking account. I get an account number and a routing number and I am able to deposit funds to this account just like any other bank. While I don’t do so, I’ve heard of some people who literally get their paychecks automatically direct-deposited right into this account so that they can operate their full day-to-day finances using Crypto.com. If I had a regular job, I would probably consider this, but you will need to make the call that is right for you. 🙂

Once you get your Visa card, then you will also have an “MCO Visa Card” account in your app. MCO is the original brand name of the company (“Monaco”) before they acquired Crypto.com and re-branded. Any funds that you move into the Visa card account is spendable using your Visa card. As I said, it works like a pre-paid Visa.

You can easily add funds to your card right from inside the app. It is easy to do and it is instantaneous. Several times, I topped up my card right before physically using it in the store and the transaction went through without any issue.

Adding Funds To Your Card So You Can Spend Them

The whole idea of Crypto.com is that it merges the crypto world and the traditional finance world so that it makes crypto more useful in daily life.

As I said above, you will get a traditional fiat wallet that you can deposit regular money (i.e. dollars) into and use like a normal bank account (just without a checkbook). And you can then SPEND that money using your Visa after you have topped up the Visa account with the funds you want to spend.

So far, that’s all just… fiat money finance. No different than what you could do with your normal bank.

The difference here is…

You can also top up your Visa using cryptocurrency.

For instance, if you’re storing some Bitcoin on your Crypto.com wallet, you can instantly convert some of that to US dollars and add them to your Visa card… which is then instantly spendable.

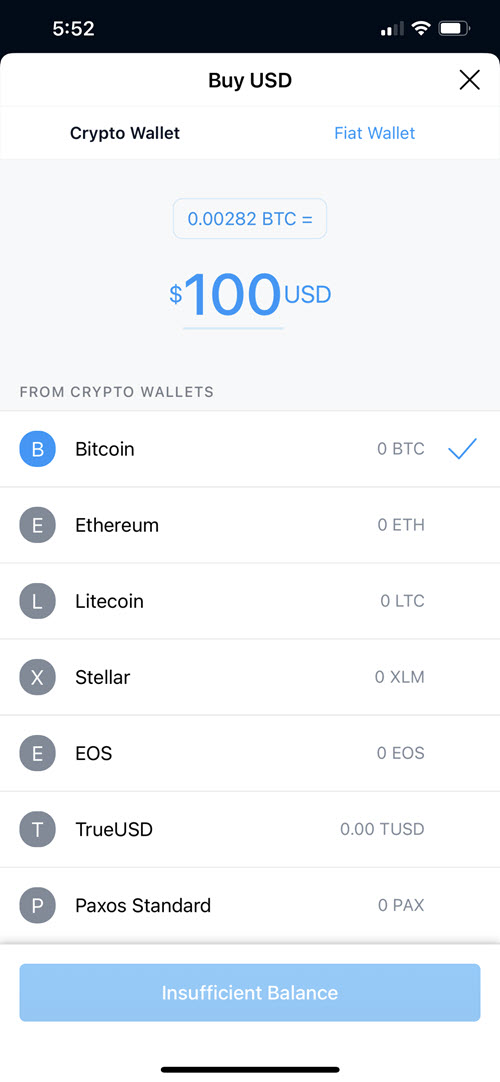

Here’s a quick example…

You’re in a store and you wish to buy something for $100. You would like to buy it with Bitcoin. A way to spend some of those Bitcoin profits. 🙂

So, you pull out your Crypto.com app right on your phone. You go to “top up” your Visa card. You enter that you want to add $100 to your Visa… and you want to use your Bitcoin wallet as your funding source.

Crypto.com will instantly withdraw the equivalent amount of Bitcoin from your BTC wallet and add it to your Visa as dollars. It does this conversion instantly and without any fees.

You can then swipe your Visa and spend that $100 on whatever you want. In terms of the store, it is just any normal Visa transaction. But, you know… you just funded it with Bitcoin. 🙂

The screenshot above shows the coins that you can currently use to top up your Visa directly. This is not a full list of all coins that you can store in your Crypto.com wallet, however. If you want to fund your card with another coin, you would first need to use the app to exchange it into a supported coin (like Bitcoin), then use it to top up your Visa.

The Cards, The Benefits, And How To Get One

At first, it can be a little confusing on exactly how you get one of these cards. But, it’s pretty simple. Let me explain…

First, you need to know about the CRO tokenSometimes referred to as a token, or a coin. The two terms are used pretty interchangeably. Essentially, it is a digital....

What is the CRO Token?

CRO is the utility token that fuels the Crypto.com world. It is, in short, a cryptocurrency.

CRO has it’s own market value, but it’s real purpose is to fuel the ecosystem of Crypto.com’s services. You can use it to buy things, get loans, get cash back on purchases (more on this in a minute), and more.

If you’re doing business with Crypto.com, you will use (and want) the CRO token.

As of this writing, the market value of CRO has been hovering in the region of $0.07 per token. You can track it’s current price on CoinMarketCap because it definitely goes up and down (like all coins). In fact, it did experience a big drop in Q4 of 2020, but it has been pretty steady every since.

As you can see, the CRO token is no joke. Now, here’s how it works with these cards…

To sign up, please use my referral link here. Or, you can enter my referral code of 4pf8ahtgbj. When you do and when you stake at least 5,000 CRO to get the Ruby Red card, you and I both will earn $25 in CRO tokens as a sign-up bonus. So, why not. 🙂

The Crypto.com Visa Card Tiers

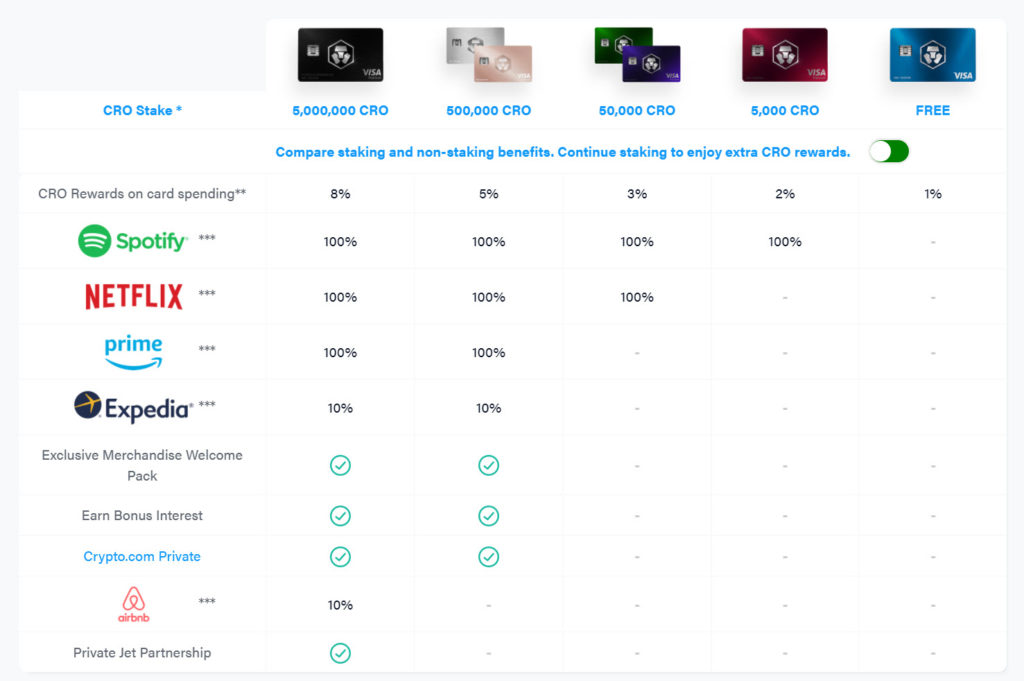

They offer 5 different tiers of cards to choose from. Each card has it’s own set of benefits, but also requires it’s own stakingAs you know, crypto/blockchain networks are decentralized and that means that the operation and security of the network ... to get it.

When you “stake” CRO, you’re essentially purchasing CRO token and then holding those tokens in an account for at least 6 months. Essentially, you’re taking a little financial interest in Crypto.com when you stake CRO to get one of these cards.

Thing is, when you stake CRO, you’re not giving them the money. Your CRO remains your’s. They’ll actually pay you interest on that CRO for as long as you leave it staked.

After the initial 6 months is up, you can sell it all and get all your money back (at whatever the market value of CRO is at the time). Many simply choose to leave it alone, however, and continue receiving the benefits and the weekly interest.

So, when you’re looking at the 5 different Visas, your “cost” is presented in the number of CRO tokens you need to purchase and stake in order to get that card. And depending on the card type you have, your benefits get better.

You can get the intro level card for free without staking any CRO at all. That card will pay you 1% cash back on all your purchases.

But, as you get higher level cards, your benefits get better. Higher cash back percentages, reimbursement of streaming services like Netflix, Amazon Prime, Spotify… all the way up to airport lounge access and even private jets.

I personally have the purple card, known as the Royal Indigo.

Currently, my card requires staking of 50,000 CRO. I get 3% cash back every time I use it. They also reimburse me for my Netflix account and Spotify. I also have use of airport lounges.

How The Benefits Actually Work In Real Life

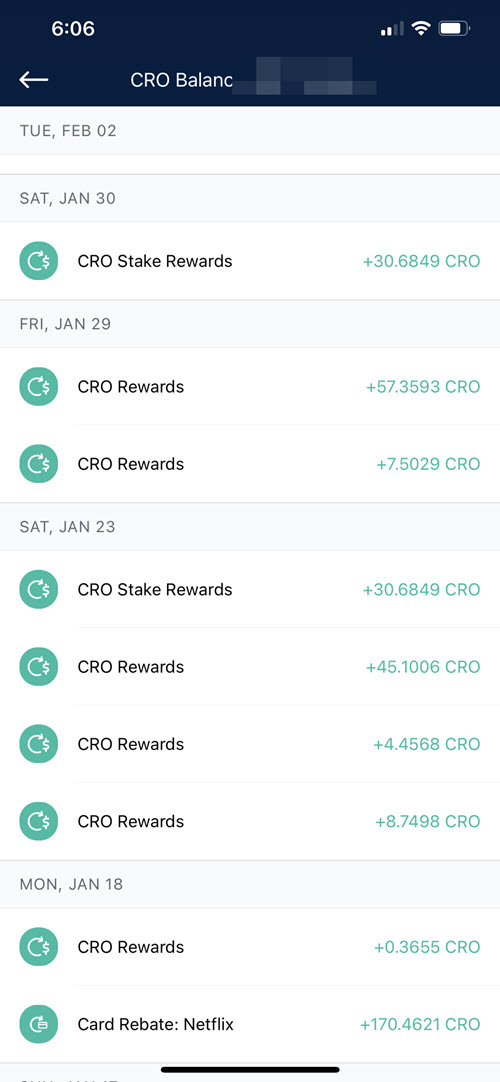

So, whenever I use my Crypto.com Visa, I get 3% cash back.

That cash back is credited to my CRO account instantly. So, if I just spent $100 on my Visa, I would instantly get $3 in CRO rewards credited to my CRO token balance.

It actually is instantaneous, too. Literally, before I even walk out of the store, I’ve already gotten a notification of the account credit on my phone. Several times, I’ve used this card in a restaurant and I will see the CRO credit on my phone before the waiter even returns to my table with my card so I can sign for it.

For Netflix and other services, all you have to do is begin paying for the services using your Crypto.com Visa. Once they see the transaction, they will instantly reimburse you in CRO.

For my last Netflix renewal, they instantly sent me 170.4621 CRO (See above). This was the equivalent of $13.99… which is what I pay for Netflix each month. They do not reimburse for sales taxes (obviously).

So, what good are these CRO tokens that you get your cash back in?

Well, they’re instantly tradeable just like any other crypto. Which means, you can convert it into another coin (like Bitcoin), use it to top up your Visa, whatever. It is as good as cash, but it just comes to you in the form of their internal cryptocurrency.

I like it because it is like getting a 3% discount – instantly – on anything I buy with this card.

This makes this card the single best card I have in my wallet. The only card that does better is my Amazon Prime card, but that’s only if I use it on Amazon to purchase Prime items. In that case, I get 5% back. So, I will use that card for most of my Amazon purchases. For anything else, I will use my Crypto.com Visa.

Cost Analysis Of These Cards – And My Recommendation

Keep in mind, when you get one of these cards, you will be required to stake a certain amount of CRO. That means you have to buy that CRO. Then, in the process of signing up for your card, you will be asked to stake the required amount of CRO token.

For this reason, you are investing some money to get the card.

As a reminder, it is truly an investment, though. You’re not GIVING Crypto.com your money. You’re investing in CRO and staking it. After 6 months, you can (optionally) sell all your CRO and cash out.

Let’s look at those costs and whether they’re worth it or not…

First, you’ve got the free card. Honestly, anybody should get this card. 1% cash back and you don’t have to stake anything at all. So, why not? 🙂

Next level is the Ruby Red card. As of this writing, you need to stake 5,000 CRO to get this card. At current market value, that’s roughly $356. You will get 2% cash back and they’ll pay for your Spotify (if you use it). That would be $155.88/year back for Spotify. If you believe you would use the card enough in one year to earn back the other $200 in cash back fees ($10,000), then it would take you roughly one year for the card to break even.

The next level up is purple or green card. That’s a 50,000 CRO stake, or a little over $3,500 at market rates as of this writing. You’ll get 3% back and they’ll pay for both Spotify and Netflix for you.

And it goes on from there. And here’s the thing…

While those high tier cards are cool, I don’t recommend them.

You’re very unlikely to have that much CRO unless you’ve already been in the ecosystem for awhile. If you’re new, then staking that amount of CRO is going to be an initial purchase – using either fiat or crypto. And it really comes down to this…

Do you want to invest that much into the company?

Now, these cards do get more expensive over time. The Royal Indigo card that I have used to require only a 10,000 CRO stake. Now, it requires 50,000. I was totally fine with the investment since I wanted to invest in CRO anyway as one of my many holdings. I happen to think the CRO token will rise in value.

But, now that they require a 50,000 CRO stake? Mmmmmm…. well, I might still have done it. I would have paid for it with crypto, but the card I have now requires about $3,500 to get it. That’s a a hard pill to swallow… and is about as high as I would ever consider at this point.

For most people, I would recommend the Ruby Red. I think it’s worth it.

And, at a minimum, get the free one.

But, those higher tier cards? Mmm… those are great if you’ve been using Crypto.com for a long time and have that much CRO. Or, you just have a lot of money to throw around. 🙂

Keep in mind, again…

You DO get this money back. You’re investing it, not spending it. AND… you will earn interest on that money while it is staked. So, really… it just comes down to how much money you are OK with parking in the Crypto.com ecosystem as an investment into CRO itself.

If you do decide to unstake your CRO after 6 months, your card benefits drop. So, personally, I just keep it there and continue to earn interest every week. For me, it is definitely worth it.

To sign up, please use my referral link here. Or, you can enter my referral code of 4pf8ahtgbj. When you do and when you stake at least 5,000 CRO to get the Ruby Red card, you and I both will earn $25 in CRO tokens as a sign-up bonus. So, why not. 🙂

How Does This Affect Your Taxes?

Right now, here in the US, every time you buy/sell/exchange crypto, that is a taxable event. This, of course, makes things rather annoying.

There are some crypto-backed Visas (from other companies) that do real-time conversion for every transaction. Meaning, you could simply buy a cup of coffee using Bitcoin and, technically, you are now subject to capital gains taxes because of a coffee. This is tedious.

The pre-paid Visa nature of the Crypto.com card is just… easier.

You control the flow of funds into the card using the top-up functionality in the app. If you top up the card using, say, Bitcoin… then that single transaction is a taxable event. Every subsequent use of the card for those funds is NOT a taxable event because those funds are already in dollar format.

So, for instance, just top off you card each month with, say, $500. All at once. You can do it with Bitcoin. That transaction is subject to taxes. But, for the remainder of your transactions where you’re deducting from that $500, it is not taxable as crypto.

This makes it simpler from a tax perspective.

My Favorite Way To Use The Card

OK, to be clear, this only works when you’re in a nice bull market. 🙂

Buy some Bitcoin – or take a small portion of BTC you already own – and move it to your Crypto.com wallet.

Then, let it increase in value.

As it does, you can occasionally top off your Crypto.com Visa using profits from the rise in Bitcoin price.

For instance, I moved some BTC over when I first got the card. It was, perhaps $2,000 worth. But, without too much time gone by… it became $2,100. Then, $2,200. And so on.

So, every now and then, go in and top off the Visa with $100 of those profits.

Honestly, it sorta feels like free money when you do that. Makes it kinda fun. 😉

I only do that for “play money” every now and then. Most of my spending on the card is funded by moving US dollars from my bank over to my fiat wallet on Crypto.com. After all, I’m not using Bitcoin to buy my groceries. 😉 But, I sure will take the 3% cash back and increase my CRO holdings.

Keep In Mind… CRO Is A Token That Can Go Up In Value

As I said, you get your “cash back” in the form of CRO deposited right into your wallet.

You can use the CRO to buy other coins (like Bitcoin)… or you can just leave it in CRO.

You can use CRO to buy gift cards (and get CRO rebates on those, too), or use it in Crypto Pay to buy items on any site which uses it.

Or…

Just keep the investment in CRO.

I can’t help but think that the USD value of the CRO token is going to increase here.

For all that this company is doing, I find it a little odd that the CRO token has been hovering in the $0.06-$0.07 range lately. I could see this coin rising up to $1 or more in the future.

Which, of course, really compounds he value of that “cash back” I’m getting from this Visa card. Or those reimbursements for Netflix.

Final Thoughts

I think the future is very bright for crypto-tied Visa cards. In fact, the CEO of Visa really came out in support of his vision for such a thing.

It just makes so much sense.

And, in the looking I have done, the Crypto.com Visa is the best one out there right now.

It offers the best benefits.

It isn’t spending crypto directly (thereby making taxes more complicated).

It isn’t a credit card, which means no debt issues.

There’s no annual fee. Just the initial investment in CRO token to stake it – and even that you could sell off and get your money back if you wanted to. Thing is, when you keep it staked, they pay you interest on it while also locking in better benefits with the card.

It’s just a good deal. 🙂

It is also a beautiful steel card and it really stands out. It is now my favorite card in my wallet. 🙂

To sign up, please use my referral link here. Or, you can enter my referral code of 4pf8ahtgbj.

When you do and when you stake at least 5,000 CRO to get the Ruby Red card, you and I both will earn $25 in CRO tokens as a sign-up bonus. So, why not. 🙂