How To Reliably Earn Interest On Your Crypto Holdings (And Blow Your Bank Away)

What kind of interest rate are you earning on your money in your bank?

I just looked at my own bank. My checking account literally earns 0.01% interest. My savings account is at 0.05%.

To call that pathetic doesn’t even cover it. It’s nothing.

So, why keep ANY money in a regular bank? Other than capital you need for standard day-to-day expenses and operations, why keep anything excess in a bank?

Even so-called “high interest savings accounts” are sitting around 0.5%. On the high side. Yes, that’s 10X higher than I’m getting in my own bank, but still… it is pathetic.

Especially when you consider how fast the value of the dollar is shrinking. 13% drop in value just last year. Your crumby 0.5% interest return does nothing to keep pace with the shrinkage.

Let me tell you about one of the best – and simplest – ways to use the new DeFiShort for Decentralized Finance. It is a brand new breed of finance that provides typical financial services in a decent... movement to your advantage.

You don’t have to understand every aspect of DeFi to use it to your advantage. And one of the BEST ways to use it is to earn a respectable return on your capital.

You will never look at your bank the same way again.

Earning Interest On Your Crypto – How It Works

There is a new breed of “bank”. A decentralized bank. Banks that work the way banks used to.

You deposit capital in an account. The bank then has the ability to turn around and loan that capital out to others. In exchangeAn exchange is a platform that enables you to exchange one currency for another currency. It is a place where people can..., the bank is paid interest. Then, that bank turns around and pays YOU part of the interest revenue. After all, it is your capital that enables them to operate.

This is the way banks used to work. Honest banks, anyway. Then things got fuzzy and we moved to a “fractional reserve” system and then, finally, to a “no reserve” system. As banks operate now, they literally just make up money out of nothing. I could go on and on about this (and will in future articles), but fiatFiat, or fiat currency, is a currency that exists and has value merely because it's home government says so. A fiat curr... currency today is the ultimate “funny money”. It is all debt based, but made up out of nothing. It’s amazing, really.

So, these new banks. They’re “crypto banks”. And they are part of the new decentralized finance movement.

As more people catch onto this, it will totally take over. I’m telling you. And here’s why…

While I get 0.01% return on my dollars in my bank, I can get a 6.2% interest rate on my Bitcoin. That’s 620X what I earn in my bank.

If I’m holding Ethereum, I can get 7.21%.

Even if you want to keep it in “dollars”, you can move it into a stablecoinA stablecoin is a particular kind of cryptocurrency which is programmed to have it's value follow and be tied to a parti... like USD Coin or Tether. And, by depositing those funds into one of these crypto banks, you can earn up to 13.86%. That is 1386X what I earn in my own bank.

This isn’t some kind of scam. It is literally funding the reverse side of this – crypto loans. Also, the rates change to suit market conditions. I wouldn’t be surprised one bit to see these rates drop as more and more people get into this and supply more liquidityLiquidity refers to the ease with which you can convert an asset back into cash (or sell it) without radically affecting... for the loans.

Options To Earn Returns On Your Crypto

The company I recommend here is called Celsius.

I will share in a minute why I prefer (and recommend) Celsius, however I want to be clear… they’re not the only game in town.

No doubt others will enter the market.

I use Celsius. And here’s how it works…

You transfer crypto to your walletWe know a wallet as a thing you keep your money in. In cryptocurrency, we use the word wallet to refer, likewise, to a p... on Celsius. By simply holding it it there (as opposed to something like Coinbase), you will earn interest. Just like a bank.

You will receive interest on a weekly basis. Usually on Mondays.

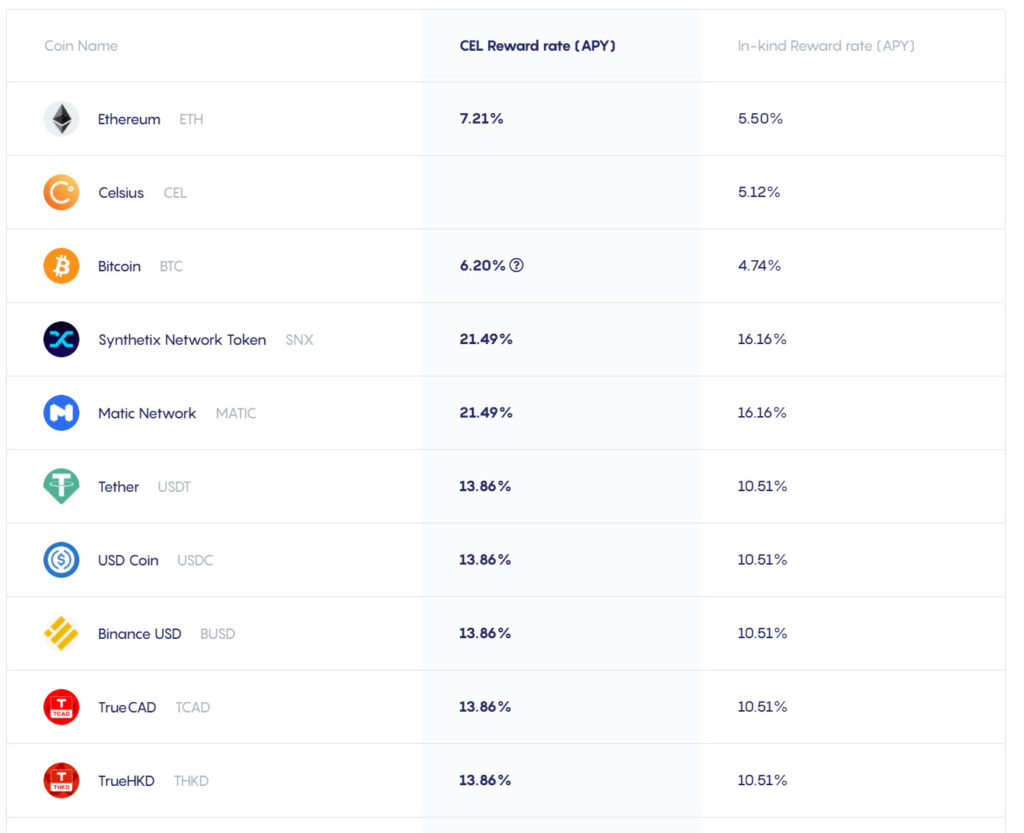

Your return rates on Celsius are published publicly.

There’s quite a list of coins there. They don’t support every cryptocurrency, but you can look at the list and see what would be useful to you.

Now, you’ll see 2 different rates there. That deserves an explanation…

The utility tokenSometimes referred to as a token, or a coin. The two terms are used pretty interchangeably. Essentially, it is a digital... of Celsius is called CEL. This is a cryptocurrency that helps power the functionality on Celsius’s proprietary blockchainBlockchain is the technology that underlies cryptocurrency. Not just Bitcoin, but all of them. Blockchain is a kind of .... It is actually a good coin and helps power their loan platform. Problem is…

In the United States, Celsius doesn’t yet have the regulatory approvals to use CEL. Which means… outside of the US, you can earn your returns in CEL. Inside the US, you cannot. Instead, you need to earn your returns directly in the crypto you’re holding.

If you have the option of earning returns in CEL, you get higher rates. But, even if you cannot, the rates are still pretty good. For in-kind rates, you will just get your interest back in the coin you’re holding. For instance, if you’re holding Bitcoin on Celsius, you will earn a 4.74% interest rate, paid to you in Bitcoin – every week.

In fact, currently, for any Bitcoin less than 2BTC, you’ll earn 6.2%. Not bad!

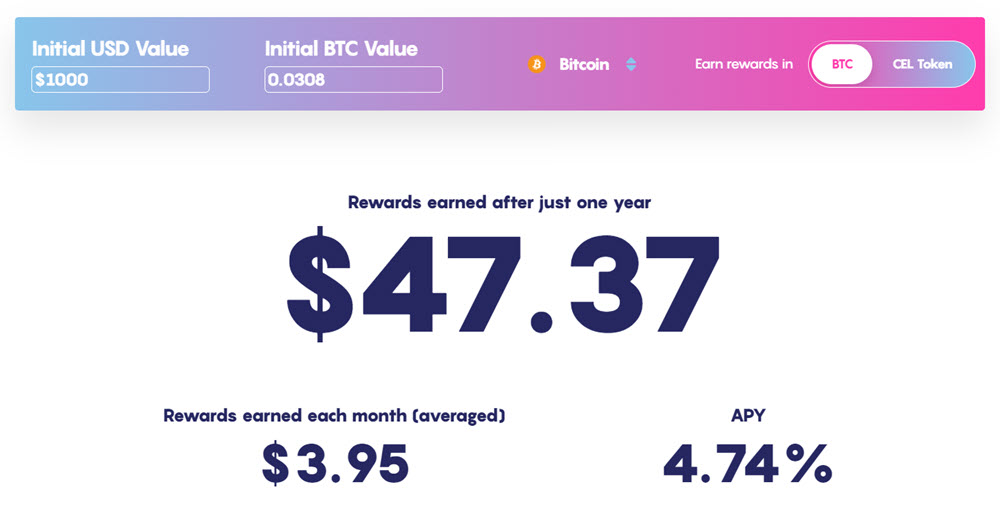

Celsius has an interest calculator on their site that will estimate your earnings based on the coin, your balance, and their current rates.

The calculator has a toggle to choose between in-kind returns or returns in the CEL token. Remember, if you’re in the US, you are not (yet) able to earn your returns in CEL.

The return rates are respectable. In the above image, you can see your estimates returns on just $1,000 in Bitcoin. $3.95 per month. Are you going to get rich coin this? Well, no. 🙂 But, it sure beats the crap out of a traditional bank right now, where a $1,000 balance would earn you 50 cents over the course of an entire year.

Now, the cool thing is that you are earning interest in a coin which hopefully is increasing.

Bitcoin is going up. If you’re earning your interest in Bitcoin, you’re just compounding your returns.

How To Get Started With Celsius

First off, sign up using this link.

Yes, this is my referral link and I’ll earn a small commission in BTC if you use it. My promo code for Celsius is 1179163c1b, and you can enter that in the Celsius app after the fact.

Celsius is operated from your mobile device only at this time. You will manage your account via an app. It is very easy to use. I would imagine, eventually, they’ll have a web app you can access from your desktop. But, for now, it is mobile only.

Celsius does comply with local regulations, so if you sign up from the United States, you will need to verify your identity. Just follow the instructions. It’s an easy process and, frankly, simpler using your mobile phone since it has an attached camera.

Moving Funds To Celsius

Celsius acts like any standard crypto wallet. You will have a wallet address for each coin it supports. Transfer coin to that wallet address and that’s all you need to do.

Merely holding the coins on Celsius means you will begin receiving interest.

Unlike some competitors, you do not need to “stake” the coins. When you stakeAs you know, crypto/blockchain networks are decentralized and that means that the operation and security of the network ... coins, you lock them up for a period of time and you cannot withdraw them until the period is over. For instance, Crypto.com also pays out interest using their Crypto Earn product. I really like Crypto.com. However, I don’t use their Earn product because you have to stake the coins. With Celsius, you can withdraw your funds any time you wish. It works just like a bank.

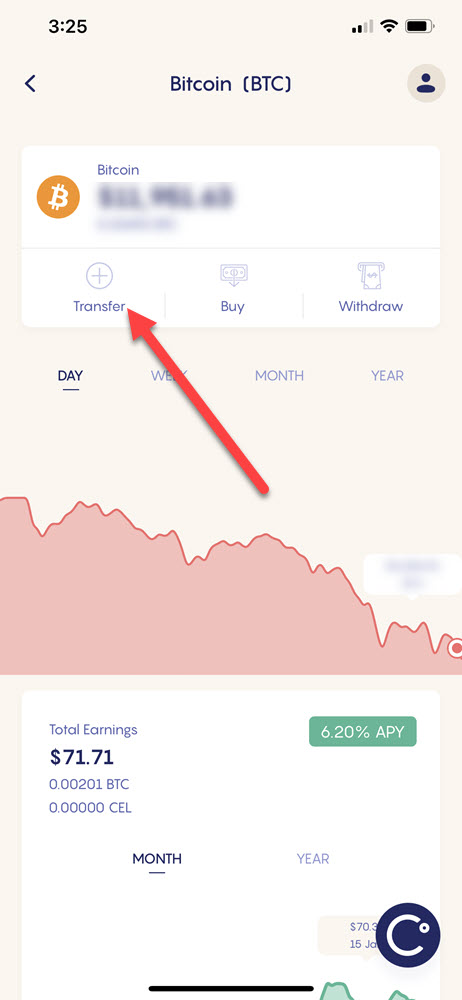

To move funds to Celsius, just click on “Add Coins”. Or if you’re already looking at one of the coins, hit the Transfer button.

Once you’re there, you’ll acknowledge a little reminder to make sure you only transfer the right coin to this wallet. Then, you’ll find your wallet address:

That’s for Bitcoin. You can use the little coin dropdown on that screen to select any other coin that Celsius supports.

From there, it is just a typical coin transfer between wallets.

So, Can You Trust Celsius?

That’s a fair question. I can tell you that I trust them. A whole lot of other people do, too.

There’s also some things that I think are important to know…

First, the company is very open about things. They partnered with ChainAnalysis to provide third party audits of their assets. This means we don’t have to take their word for the fact that they actually have the assets to back up the funds deposited.

See, with normal banks, people take some kind of comfort in FDIC insurance. The funny thing is… if you actually look into the FDIC, they don’t have the funds to cover any significant event. In many ways, the FDIC is a false sense of security. Not to mention, those dollars are funny money anyway. And our whole banking system works with no backing.

With Celsius, your funds are leveraged 1:1. The funds they lend out, they actually have. If something weird happened on their platform, they have the funds to reimburse you for any losses. And that fact has been third-party verified.

I also like how open the company is. The CEO himself (Alex Mashinsky) is very open on social media and does AMAs regularly.

So, I can only speak for myself here, but I trust Celsius.

I will say, however, that I do not store all of my crypto on Celsius. Most of it is on hardware wallets. But, I do keep a decent amount on Celsius… and I earn interest on it every week.

Celsius is a custodial wallet. So, they hold the keys. But, in that aspect, it is no different than any exchange. While I won’t hold everything there, it’s definitely worth holding some. And if the amount of crypto you hold isn’t very much, I’d say… move it all to Celsius. You might as well earn some interest on it.

Compounding Returns – Just Makes Sense

So, instead of earning less than peanuts in your bank, you can consider moving some to Celsius.

If you’re in the US, you’ll earn interest back in the same cryptocurrency you’re holding. If you’re outside the US, you can earn a higher rate back by taking your returns in the CEL token.

The CEL token itself is performing very well because Celsius is growing like crazy. Look at this chart…

So, if are able to take returns in CEL, you might as well just hold onto that CEL token. Seems like a great investment anyway.

But, in my case, being here in the US, I don’t have that option. So, I take my returns in-kind. So, for instance, I hold some Bitcoin on Celsius. I earn a 6.2% return on that. But, on top of that, I also get to ride the increasing value of Bitcoin up.

So, if the goal is to make more dollars, you’re not only riding the coin value up, but you’re giving it an extra boost by earning interest in that same coin.

Of course, keep in mind, that also means you can ride the coin values down if we enter a bear market. So, it goes both ways.

Lastly, interest compounds. Each week, your coin balance will increase a little bit. Then, the following week, it uses that NEW balance to calculate interest for the new week. And so on. So, it is a compounding, weekly interest.

Not a bad deal. 🙂

I earn more interest in one week with crypto on Celsius than I do in a full year with my bank.

‘Nuf said, really.